Tenancy Agreement Stamp Duty Malaysia

Up until 30 June 2021 stamp duty is paid when the purchase price exceeds 500000. In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949.

Guide To Tenancy Agreements In Malaysia

Landlord S Guide How To Rent Out Your Hdb Flat In Singapore

Ministry Of Finance Suspends Stamp Duty On Native Title Transactions Borneo Today

The rules around the amount of notice required vary from state to state but landlords generally need to give more notice than the tenant.

Tenancy agreement stamp duty malaysia. Stamp duty is a tax on legal documents in Malaysia. This website belongs to GTRZ. In general term stamp duty will be imposed to legal commercial and financial instruments.

QLD payable within 30 days of settlement. Home Malaysia Law Firm Malaysia Law Statutes Legal Fee Stamp Duty for Sale Purchase Agreement Loan The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law. Normally there are two copies of the tenancy agreement.

However if there has been a breach of your tenancy agreement for example if youve fallen behind on rental payments or damaged the property a landlord can serve you with a Section 8 notice which gives you just two weeks notice to. What is stamp duty. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord.

The stamp duty on rental units also applies to extension of lease or renewal of the tenancy agreement. However stamp duty charges cannot be backdated. Please contact us for a quotation for services required.

Pros and cons of periodic tenancy. Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. Stamp Duty Malaysia On A Loan Agreement.

Enter the monthly rental duration number of additional copies to be stamped. On 1 July 2021 the threshold will reduce to 250000 until 30 September 2021 and then from 1 October 2021 the threshold will revert to 125000. The tenancy agreement will only come into effect once the stamp duty has been paid and all the relevant stamps and seals are in place.

Ii After completion of Tempoh kontrak year tenancy period from the date hereof if the Tenant desires to terminate the Tenancy Agreement before the expiration of the term hereby created the Tenant shall be required to give a three 3 month written notice of such sooner determination. Kelana Square 17 Jalan SS726 47301 Petaling Jaya Selangor Darul Ehsan Malaysia. A periodic tenancy is a month-to-month agreement that continues until either party gives notice.

Who should buy a stamp paper for a rental agreement. A rental agreement can be given retrospective effect within the terms of the agreement. Easily calculate legal fees stamp duty RPGT.

Stamp duty fees are typically paid by the buyer not the seller. Online calculator to calculate Tenancy Agreement Stamp Duty. You can be given this notice if your tenancy has no fixed end date which is known as a periodic tenancy or after your fixed-term tenancy ends.

This stamp duty is paid to the Inland Revenue Authority of Singapore IRAS. When the tenancy is up for renewal the next agreement will be with the new landlord. TAS payable within three months of the transfer which.

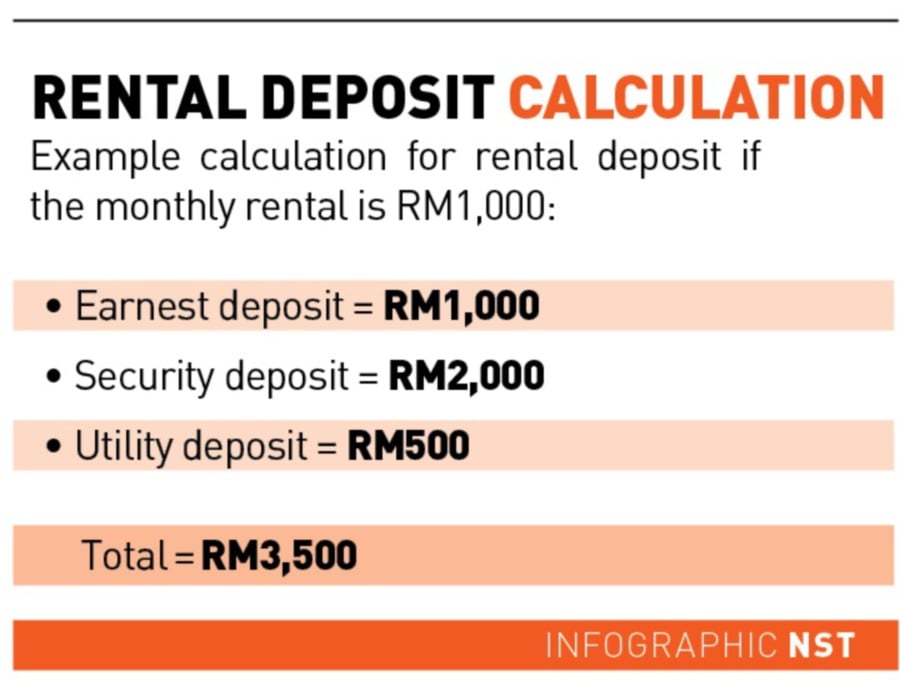

A tenancy agreement stamp duty which is a form of taxes placed by the government on legal documents will have to be paid to finalize a tenancy agreement before a rental can happen. Iii However prior to the completion of a year Tempoh kontrak year period from the date hereof-. Instruments liable to stamp duty are those listed in the First Schedule of the Stamp Act 1949 EXEMPTIONS RELIEF FROM STAMP DUTY General exemptions under Section 35 in First Schedule Stamp Act 1949 and Specific exemptions under item 2 4 and 32 in First Schedule Stamp Act 1949.

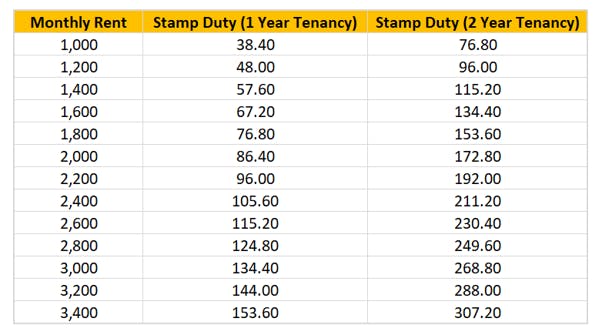

The stamp duty for a tenancy agreement in Malaysia is calculated as the following. The whole process of renting a property in Singapore including reading the Tenancy Agreement can be drainingThis is especially if youre renting for the first time. In this article we walk you through the 7 common clauses you should pay more attention to before you sign the Tenancy Agreement.

SA payable on settlement day. Stamp Duty Land Tax SDLT is a tax paid by the buyer of a UK residential property. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400.

Akta Malaysia Commissioner for Oaths directory is available. This has to be in writing and must specify when the agreement will end. EasyLaw - the best calculator phone app for Malaysia Lawyers.

Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. The stamp duty is free if the annual rental is below RM2400. As an important legal document the loan agreement is also liable for stamp duty.

So what is stamp duty all about again. New South Wales. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan.

A Periodic Tenancy Alternatively the new landlord may let the tenancy roll over and become a Periodic Tenancy this is when neither landlord nor tenant signs another agreement so a Periodic Tenancy automatically follows on with the same terms and conditions as the previous one. There are two types of Stamp Duty namely ad valorem duty and fixed duty. Either the landlord or the tenant can buy the stamp paper.

28 days before lease ends. Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of Transfer and Loan Agreements. To use this calculator.

Its also important to factor in the stamp duty owed for any loan agreement which may be entered into as part of a property purchase. At least 14 days if the date is at the end of the tenancy agreement or 21 days if the end date is after the fixed term. When the purchase is made off the plan buyers must pay duty within three months of the completion of the agreement.

NT generally payable within 60 days of entering into the transaction or at settlement whichever is earlier.

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Tenancy Agreement

1

Tenancy Agreement And Security Deposit What Renters Must Know

2020 Stamp Duty Exemptions News Articles By Hhq Law Firm In Kl Malaysia

Instahome S Tenancy Agreement Guide

Uptown Properties 2013

Tenancy Agreement Charges And Stamping Fee Calculation In Malaysia

You have just read the article entitled Tenancy Agreement Stamp Duty Malaysia. You can also bookmark this page with the URL : https://wyattctxz.blogspot.com/2022/02/tenancy-agreement-stamp-duty-malaysia.html

Belum ada Komentar untuk "Tenancy Agreement Stamp Duty Malaysia"

Posting Komentar